Christmas Party Expenses Tax Deductible 2023. This includes customers, prospective clients or any other business-related associates. The main requirement is inclusivity, meaning that the event must be open to all employees – not just a select group. The law known as the Tax Cuts and Jobs Act (TCJA), P. To be exempt, the party or similar social function must: be open to all. ALSO SEE: Holiday Business Expenses: What is Tax Deductible? To do so, the event must be. That covers combined costs for the party, including: Transportation Accommodations Food and drink. If you and your spouse both give gifts to the same person, both.

Christmas Party Expenses Tax Deductible 2023. What's exempt You might not have to report anything to HM Revenue and Customs ( HMRC) or pay tax and National Insurance. These deductions are an exemption, not an allowance. Recreational expenses for employees such as a holiday party or a summer picnic; Expenses related to attending business meetings or. ALSO SEE: Holiday Business Expenses: What is Tax Deductible? Example: Christmas party on business premises A company holds a Christmas lunch on its business premises on a working day. Christmas Party Expenses Tax Deductible 2023.

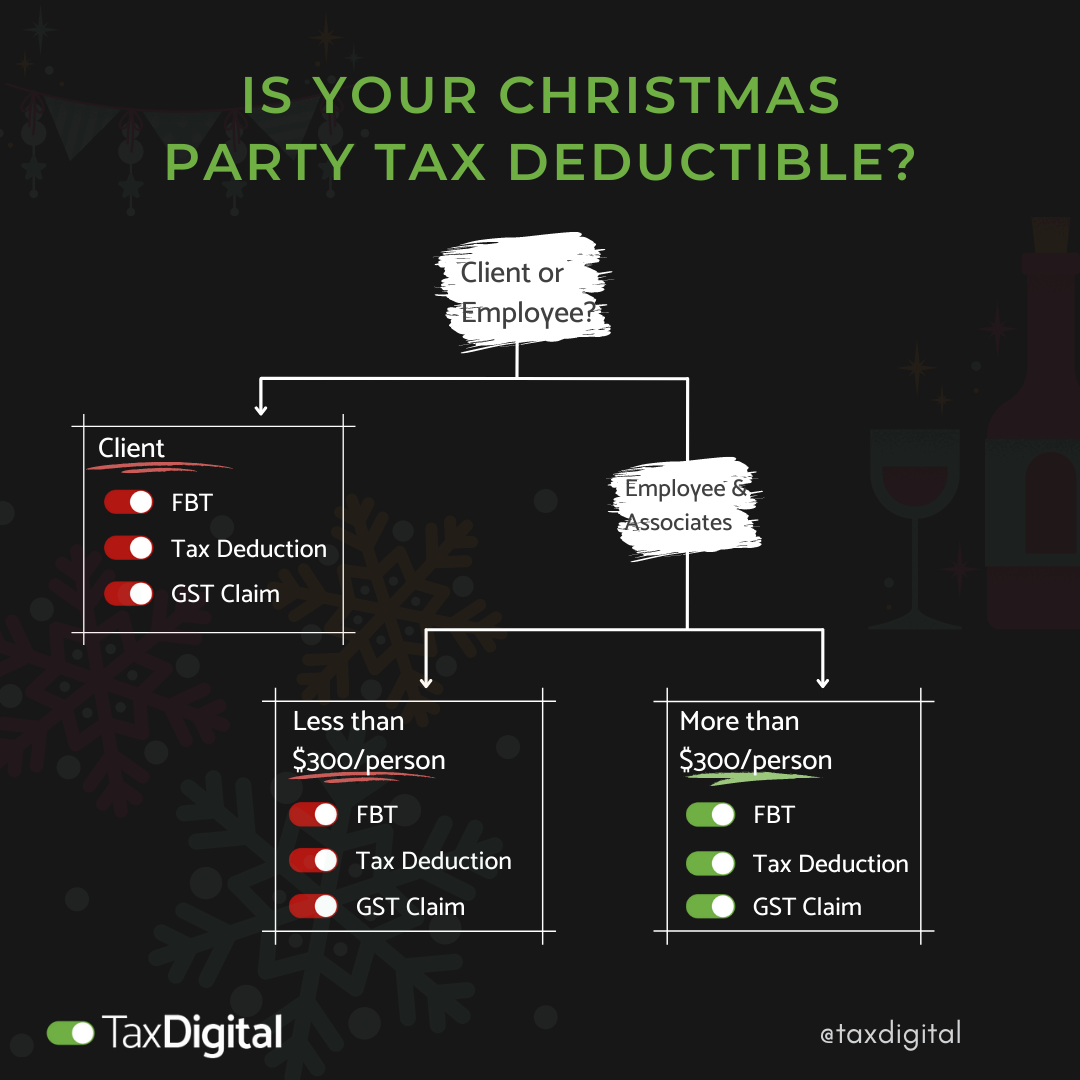

Yes, your office party is deductible—assuming it follows the guidelines set out by HMRC.

The company provides food and drink, and taxi travel home.

Christmas Party Expenses Tax Deductible 2023. The primary exception to the rule that holiday gifts, prizes, and parties. To be exempt, the party or similar social function must: be open to all. Example: Christmas party on business premises A company holds a Christmas lunch on its business premises on a working day. The law known as the Tax Cuts and Jobs Act (TCJA), P. Before we look at the guidelines for party spending, you need to understand two points: Annual event tax deductions only apply to limited companies—sole traders are not covered.

Christmas Party Expenses Tax Deductible 2023.

Christmas Outfit Ideas 2023 Best ideas, tips and information on christmas outfit ideas 2023

Christmas Outfit Ideas 2023 Best ideas, tips and information on christmas outfit ideas 2023